unemployment tax break refund how much will i get

But in March the American Rescue Plan waived taxes on the first 10200 in unemployment income or 20400 for a couple who both claimed the benefit for those who made less than 150000 in adjusted gross income in 2020 in light of the coronavirus pandemic. 10200 Unemployment Tax Free Refund Update How to Check Your Refund Date CA EDD and All States How to pull your IRS transcript to check the status of irs unemployment benefits refunds.

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits.

. How to calculate your unemployment benefits tax refund. Refund for unemployment tax break. By filling in the relevant information you can.

The Internal Revenue Service IRS announced it will start to automatically correct tax returns for those who filed for unemployment in 2020 and. A tax return calculator takes all this into account to show you whether you can expect a refund or not and give you an estimate of how much to expect. Tax Refunds On Unemployment Benefits Still Delayed For Thousands.

When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. Normally any unemployment compensation someone receives is taxable. Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a year.

This handy online tax refund calculator provides a simplified version of the IRS 1040 tax form. Refund for unemployment tax break. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year.

Generally unemployment compensation is taxable. The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person. The Internal Revenue Service IRS said that it would start sending tax refunds to those eligible for the 10200 unemployment tax waiver.

Pin On Pkgp Tweens And Teenagers Tax refund time frames will vary. Unemployment Income Rules for Tax Year 2021. The American Rescue Plan Act a pandemic relief law waived federal tax on up to 10200 of unemployment benefits per person collected in 2020 a year in which the unemployment rate spiked to.

Unemployment tax refund 2021 how much will i get. You might also qualify for so many tax deductions and tax credits that you eliminate your tax liability and are eligible for a refund. You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000.

The 19 trillion Covid relief bill gives a tax break on unemployment benefits received last year. While taxes had been waived on up to 10200 received in unemployment for those making less than 150000 in 2020 -- the first year of the pandemic -- that was only temporary relief and no such. This summer the IRS started making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who qualify for a 10200 unemployment tax break.

As Americans file their tax returns for 2020 -- a year riddled with job insecurity -- millions who relied on unemployment insurance during the. The IRS has sent 87 million unemployment compensation refunds so far. The child tax credit checks began going out in july and will continue monthly through december for eligible families.

This summer the IRS started making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who qualify for a 10200 unemployment tax break. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. The IRS has sent 87 million unemployment compensation refunds so far.

The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. You do not need to take any action if you file for unemployment and qualify for the adjustment. The IRS has identified 16 million people to date who may qualify for an associated tax refund or other benefit.

The IRS recently announced that it will start to automatically correct tax returns for those that filed for unemployment in 2020 and also. Fourteen states will end additional unemployment benefits in june. The measure allows each person to exclude up to 10200 in aid from federal tax.

Depending on how much you received in benefits last year along with your income and filing status you could see a refund of 1000 to 3800 according to multiple media reports. If I paid taxes on unemployment benefits will I get a refund. The 10200 is the amount of income exclusion for single filers not the amount of the refund.

In the latest batch of refunds announced in November however the average was 1189. President Joe Biden signed the pandemic relief law in March. Irs unemployment tax break refund status.

An unemployment tax refund is a great way to get money back on taxes that youve already paid.

![]()

What You Need To Know About Unemployment Tax Refund Irs Payment Schedule And More

Over 7 Million Americans Could Receive Refund For 10 200 Unemployment Tax Break

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Com

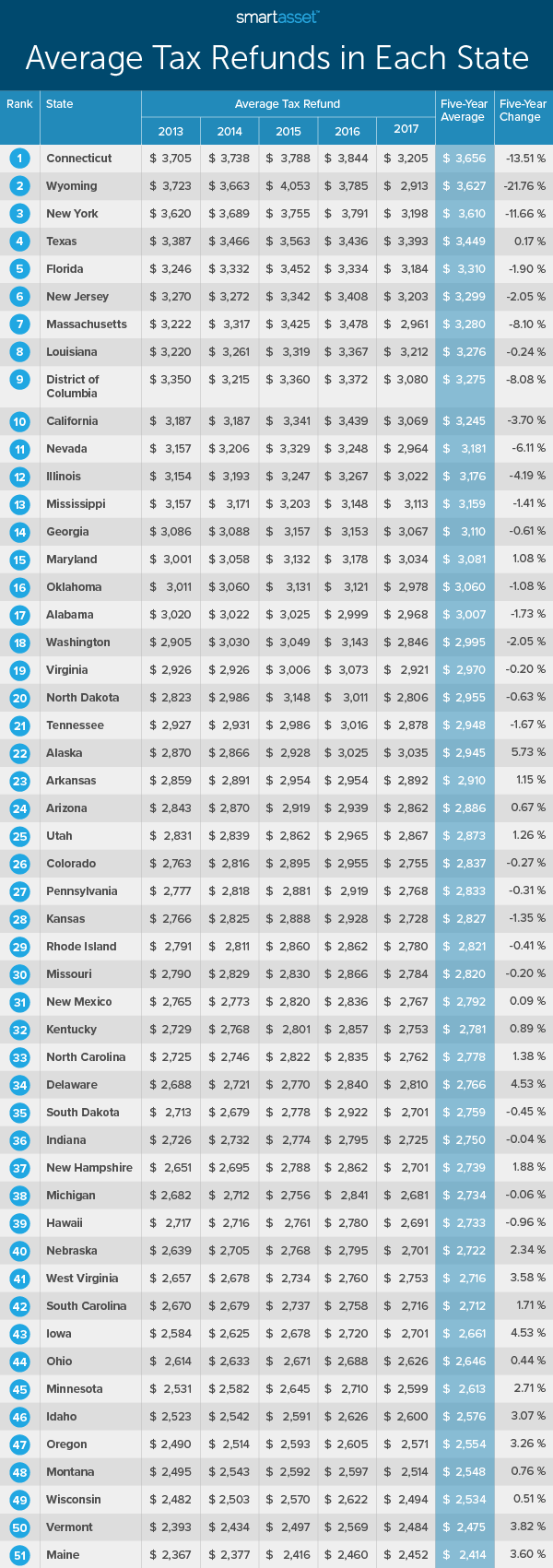

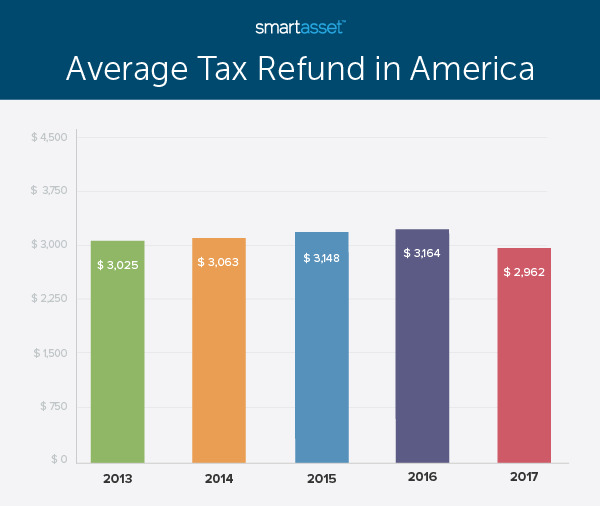

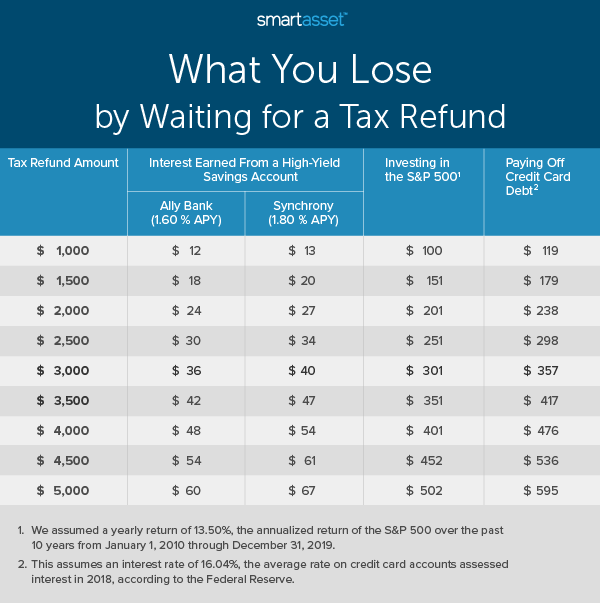

Tax Refunds In America And Their Financial Cost 2020 Edition Smartasset

Time Running Out For Ohioans Claiming 2017 Tax Refund

How Will Unemployment Tax Break Refund Be Sent In Two Phases By The Irs As Com

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Tax Refunds In America And Their Financial Cost 2020 Edition Smartasset

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status

Tax Refund Timeline Here S When To Expect Yours

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Tax Refunds In America And Their Financial Cost 2020 Edition Smartasset

Ohio Income Tax Refund For Working From Home Gudorf Tax Group

Get My Refund 12 Million Tax Returns Trapped In Irs Logjam Should Be Fixed By Summer 6abc Philadelphia

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

When Will You Get Your 2021 Income Tax Refund Cpa Practice Advisor